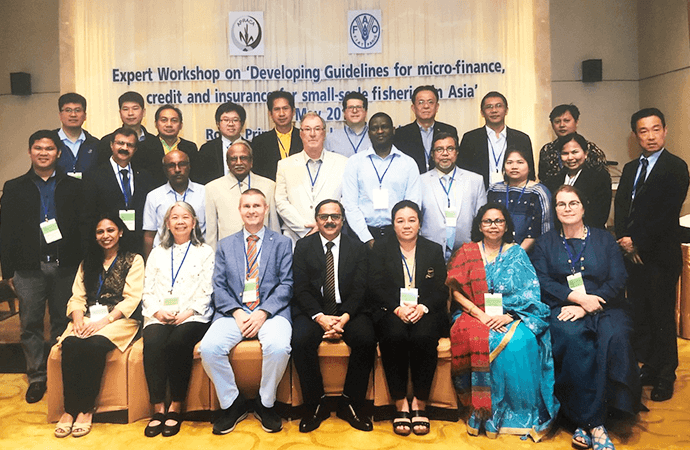

Rural finance and fisheries experts from Bangladesh, China, India, Indonesia, Japan, Philippines, Thailand, UK. Canada and the USA met during 7-9 May in Bangkok, Thailand and discussed the ways to improve the access to financial services for small-scale fishers in Asia. It is estimated that there are more than 30 million small-scale fishers in Asia.

Rural finance and fisheries experts from Bangladesh, China, India, Indonesia, Japan, Philippines, Thailand, UK. Canada and the USA met during 7-9 May in Bangkok, Thailand and discussed the ways to improve the access to financial services for small-scale fishers in Asia.

It is estimated that there are more than 30 million small-scale fishers in Asia. Their contributions to society in terms of support to national food security, nutrition, employment, coastal livelihoods and export earnings, are important.

However, a large majority of these small-scale fishers do not have access to formal financial services, such as micro-finance, savings, credit and insurance. Reasons for not having access are many, including amongst others the limited collateral they can provide, low investment capacity, the geographical dispersion of coastal fishing communities and high illiteracy levels among fishers. On the other side, financial institutions often do not have sufficient knowledge about the sector to assess the risks involved and may see the subsector as unattractive in terms of business and profit-making prospects. Moreover, the government financial policies and laws often do not take in consideration the situation in fisherfolk

communities and the specific needs of fishers.

The Expert workshop on Guidelines for micro-finance, credit and insurance for small-scale fisheries in Asia aimed to discuss successful finance programmes in Asia for small-scale fishers, finalize practical guidelines in support of better access to financial services, and design a capacity building programme for increasing the provision of financial services to small-scale fisheries.

The expert workshop, attended by 32 experts, was organized on 7-9 May by the Asia-Pacific Rural and Agricultural Credit Association (APRACA) in close collaboration with the Food and Agriculture Organization of the United Nations (FAO) at the Hotel Royal Princes Larn Luang , Bangkok.

Dr Prasun Kumar Das, Secretary General of APRACA, said that some members of his association are providing credit to small-scale fishers, but that there are also many rural banks in the region that would need capacity building for addressing the financial needs of small-scale fishers and their communities. He welcomed the sharing of experiences and lessons learnt by the regional and international experts at the workshop and emphasized that the guidelines produced will help his members to supply credit in a more effective manner to small-scale fishers.

Dr Raymon van Anrooy, Senior Fishery Officer of FAO, mentioned that the insurance and credit guidelines prepared will facilitate the implementation of the 2014 Voluntary Guidelines for Securing Sustainable Small-Scale Fisheries in the context of food security and poverty eradication, as well as contribute towards achievement of Sustainable Development Goal 14: Conserve and sustainably use the oceans, seas and marine resources for sustainable development. Access to financial services will enable the small-scale fishers to invest in more responsible fishing operations and technologies, reduce overfishing, contribute to fisheries management and implement climate change adaptation measures. During three day of the workshop, the experts discussed financial inclusion and financial services programmes in Asia for small-scale fishers, finalized guidelines in support of better access of small-scale fishers to financial services, and designed a capacity development programme for increasing the provision

of financial and insurance services to small-scale fisheries. The group observed many potential areas for improvement and some of the mutually agreed observations are:

(a) access of small-scale fishers (SSF) to micro-finance, credit and insurance services is limited in most countries in Asia, compared to financial services availability for farmers and other rural sectors,

(b) SSF finance shares many common characteristics with agriculture and other rural finance, but also has some unique elements (such as specific daily working capital needs, uncertainty in catches, seasonality, labour risks, moral hazard, limited collateral, perishability of products, and some declining markets), which must be considered when supporting improved access,

(c) There are some initiatives that successfully target the financial needs of small-scale fishers, and could serve as examples for the region,

(d) Financial literacy among SSF remains weak in most Asian countries, including a limited understanding of the financial situation of their fishing business, cash flows generated, business risks involved, and which results in limited access to financial products.

Based on the potentials, the foremost recommendations of the expert group are that:

a) APRACA members encourage implementation of the Voluntary Guidelines for Securing Sustainable Small-Scale Fisheries in the Context of Poverty Eradication and Food Security (SSF Guidelines), as endorsed by the 31st Session of the FAO Committee on Fisheries (COFI) in 2014,

and particularly its article 6.4 “support the development of and access to other services that are appropriate for small-scale fishing communities with regard to, for example, savings, credit and insurance schemes, with special emphasis on ensuring the access of women to such services”.

b) APRACA members, rural and agriculture finance institutions, fisheries and finance authorities, NGOs and other stakeholders endorse, as relevant, and actively promote the implementation of the FAO-APRACA; i. Guidelines for increasing access of small-scale fisheries to insurance services in Asia, and ii. Guidelines for micro-finance and credit programmes in support of small-scale fisheries in Asia.

c) FAO further develops the Programme on Capacity building for small-scale fisheries in micro-finance, credit and insurance services (CABFIN SSF) and seeks support from the SSF Umbrella Programme, and FAO and APRACA members as well as micro-finance, credit and insurance

institutions and other industry actors, for its implementation in the Asian region.

d) Fisheries authorities to collect and make available production information, socio-economic data of fishers (including a fishers registration/record) and loss and damage assessment reports following natural disasters, specifically on small-scale fisheries, to facilitate financial services market and risks assessments.

e) Fisheries authorities, in close consultation with relevant ministries, make third party liability insurance (where available) mandatory for obtaining and renewal of respectively fishing vessel registrations, fishing licenses and authorizations to fish.