Feature WeChat Official Account CFPAMF Financial Launched Jan.18,2018, CFPAMF Financial, a WeChat Official Account, debuted. It developed three major functions including loan application, loan procedure tracking and service center, which facilitate loan application, reduce costs, customize services and improve risk control. In fact, a high cost of acquiring customers and marketing is challengeable to CFPAMF

Feature

WeChat Official Account CFPAMF Financial Launched

Jan.18,2018, CFPAMF Financial, a WeChat Official Account, debuted. It developed three major functions including loan application, loan procedure tracking and service center, which facilitate loan application, reduce costs, customize services and improve risk control.

In fact, a high cost of acquiring customers and marketing is challengeable to CFPAMF business development. Since 2010, CFPAMF has been dedicated to digitalization to face challenges. Wechat, as one of most popular social media in China, had 902million active users per month by the end of September 2017, in terms of Tencent official announcement. And in 2015, news reports said that WeChat covered over 90%of smart phones in China. More and more rural residents become netizens and smart-phone users. Making use of social media to optimize customer relations management becomes a landmark in the history of CFPAMF.

The Heat

CFPAMF Star Project

Enlightens Microfinance Practice in China

To CFPAMF Star Project, the year of 2017 is fruitful and bright. There had been 31 applicants nationwide including universities, research institutes and NGOs to apply for projects since this program kicked off last April in Beijing. Only 6 teams were selected ,respectively from Shanghai New York University, Research Center for Rural Economy of Ministry of Agriculture of China, Social Resource Institute, Xiamen University, Nanjing Agricultural University, and Tsinghua PBCSF.

Six teams presented research works in different fields such as The Impacts of Financial Literacy Standards of Chinese Farmers on Loan Risk and Demand, On Challenges and Opportunities Faced by Rural Cooperatives in China, An Analysis and Exploration of “Farmer-Business” Docking Model in Eco-products via E-Commerce Platforms.

In addtion, KPMG , as a top player in international consulting circle, not only financed 2017 Star Project and supported two research tasks, but also some staffs of KPMG took part in as tutors.

CFPAMF Star Project, held annually, was initiated by CFPA Microfinance in 2015. Its main goal is to build a research platform to call upon more young scholars, finance opinion leaders and top professionals to pay close attention to microfinance practice in rural China.

Dialogue

Dr. Minchao Jin: This Is Where the Scholars Can Help

Minchao Jin, MSW, PhD

Global Network Assistant Professor,

Silver School of Social Work, New York University, NY, USA

New York University, Shanghai, China

What is your assessment on financial literacy in rural China?

Rural residents in China generally have a low level of financial literacy, particularly the elderly and those with low educational attainment. Results of our study funded by CFPAMF confirmed that 50% of the sample are not very financially knowledgeable, but in the low level category.

What are the challenges and opportunities faced by Chinese financial institutions while promoting financial education in rural China?

Given the factual low level of financial literacy and the emphasis on financial education through policy, the opportunity is clearly there. However, there are still many challenges. First is about the content. Financial literacy is context-based. Current research and interventions on financial literacy are primarily conducted in developed regions. Although the financial environment in China has some similarity to those regions, we still have to be aware of the differences, particularly when promoting education in rural areas. For example, in our current research, we find that knowledge more relevant to the daily life of rural residents may not be the same as needed by other groups, and vice versa. Another example would be reducing risk by diversifying investment is more applicable in other areas, but not in rural China, as the rural group does not have many various opportunities to invest. Thus, it’s important to figure out what financial knowledge is needed the most by the rural population, which is part of what we are doing. Second is about the delivery. How to deliver financial education to this group is another big challenge. Leaflets, posters and lectures may work for some, but not for all. We have to design a delivery approach that fits our populations. For instance, young people may prefer short messages via social media or even games, which are not suitable for the elderly.

Do you think public-private partnership is an efficient way to improve financial education and literacy standards in rural China? Why and How?

I think so. Financial services are provided by both public and private sectors. The financial environment is for and enjoyed by both public and private sectors. Therefore, both parties share the same goals and motivations in promoting financial education. Moreover, public and private sectors each has their own advantages in delivery. I definitely think it worth it to cultivate on the public-private partnership.

Are there any recommendations you would like to make as to improving financial education in rural China?

As noted above, the demand and opportunity are obviously there, but not without challenges, primarily in the areas of content and delivery. I think stakeholders have to work collaboratively to design an education program based on the demand and preference of the target population, the process of which should also include rigorous evaluations to assess and improve the effectiveness of it. This is where the scholars can help.

Inside CFPA Microfinance

Salons to Share Accomplishments of 2017 Star Project

Last December, Cooperation & Exchange Center of CFPAMF organized series of salons to share accomplishments of 2017 Star Project for two days. Research teams, business partners, and some headquarter staffs were invited to participate. Meanwhile, regional colleagues shared presentations on line.

Successfully Holding Hands with Rural Cooperative in Shandong Province

Rural Cooperative Finance Center of CFPAMF cooperated with a Rural Cooperative in Shandong province on Mutual Aid Fund Among Poor Villages (The Fund). CFPAMF provided technical assistance including institutional construction, products design and capital management, and financial services as well.

Dates back to 2015, financed by ADB, CFPAMF provided such technical assistance in reform of project of the Fund in Inner Mongolia Autonomous Region of China for the first time, to improve the efficiency, penetration and financial sustainability of the Fund. The Fund, jointly initiated by the State Council Leading Group Office of Poverty Alleviation and Development and Ministry of Finance of China, kicked off for poverty alleviation in 100 villages of 14 provinces nationwide in 2006.

Spotlight

On Dec.3,2017, at Global Social Finance Forum 2017 Social Impact Investing Summit, China Impact Investing Innovation Award for Excellence was awarded to Mr.Liu Dongwen, General manager of CFPAMF.

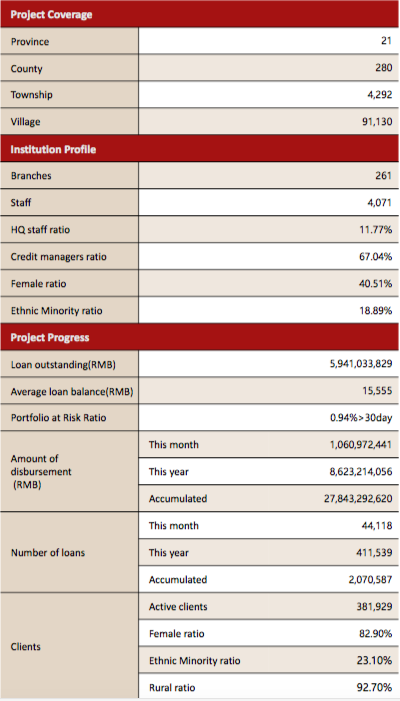

Progress