APRACA Newsbits, March-April 2010 Kathmandu, Nepal- FinPower GreenFinance Forum Held GreenFinance forum participants. APRACA FinPower, in collaboration with Nepal Rastra Bank (NRB), conducted the FinPower GreenFinance Forum: Integrating renewable energy and environmental sustainability into rural financing in Kathmandu, Nepal on March 2-5. The forum brought together Asian financial institutions and international development agencies to share

APRACA Newsbits, March-April 2010

Kathmandu, Nepal- FinPower GreenFinance Forum Held

GreenFinance forum participants.

APRACA FinPower, in collaboration with Nepal Rastra Bank (NRB), conducted the FinPower GreenFinance Forum: Integrating renewable energy and environmental sustainability into rural financing in Kathmandu, Nepal on March 2-5. The forum brought together Asian financial institutions and international development agencies to share their experiences on the topic.

The forum, with a total of 31 participants, was opened by NRB Deputy Governor Bir Bikram Rayamajhi. NRB Acting Governor Krishna Manandhar officiated the closing ceremony.

Participants in jovial mood after trekking up to a mountain mini-hydro project.

Main presentors were Dr. Chaulagain, AEPC Executive Director and Dr. Ganesh B. Thapa, IFAD Asia Division Regional Economist. Additional paper presentations were from Bangladesh Bank, ASA Bangladesh, Rural Development Bank of Cambodia, IFAD RLIP Project, Attapeu, Lao PDR, IFAD RPRP Project (Mongolia), Nepal Rastra Bank, Agricultural Development Bank (Nepal), Clean Energy Development Bank (Nepal), Center for Microfinance, Nepal, Rastriya Banijya Bank (Nepal), Sana Kisan Bikash Bank (Nepal), IFAD WUPAP Project (Nepal), CARD MRI (Philippines), Land Bank of the Philippines and the Bank for Agriculture and Agricultural Cooperatives (Thailand).

Forum participants pose with host XacBank senior officers and APRACA SG.

The IFAD-APRACA FinPower Program, in collaboration with XACBank of Mongolia convened the FinPower National Microfinance Development Forum in this city on March 16. Mr. Praful Dholakia of NABARD provided expertise during the forum as well as provided key technical support to the Bank of Mongolia, XACBank and other microfinance stakeholders on March 17- 19. Mr. Bold Magvan, CEO, XacBank, graced the one-day forum. Presentors during forum were Ms. Oyunchimeg, Director of Microfinance Department, Financial Regulatory Committee on the Status of Rural and Micro Finance Policy Environment and Regulatory Framework in Mongolia, Ms. Nergui, consultant, Achid Finance, and Ms.Onon, Together Against Poverty – Organic Mongolia Program.

A total of 33 participants from the Bank of Mongolia, XacBank, microfinance institutions, cooperatives and government agencies joined the forum.

Manila, Philippines- CENTRAB Holds Microfinance Visit

Participants join Atty. E. Garcia, CENTRAB Managing Director (first row, center).

The study visit program, Microfinance: Challenges, Risks and Expectations, was successfully held on March 15-22 in Manila, Philippines, attended by 7 foreign delegates from Bhutan, Pakistan and Sri Lanka as well as 4 local participants. This program was designed to provide the participants with all facets of microfinance operations in the Philippines. The Philippines has been adjudged by the Economist Intelligence Unit of London as the 3rd best among 55 countries in the world practicing microfinance. It is ranked first in the legal and regulatory framework index, one of the criteria used in the ranking of microfinance practicing countries.

Institutional key players in Philippine microfinance from regulatory government agency to wholesalers and retailers were visited for in-depth discussion on their respective initiatives, policies, programs and microfinance products. Among them were Bangko Sentral ng Pilipinas, Rural Bankers Association of the Philippines, the People’s Credit and Finance Corporation, Microenterprise Access to Banking Services and two rural banking institutions. GM Bank, a northern Philippine rural bank, which spearheaded the adoption of mobile phone banking in the Philippines, was also visited by the group.

Agricultural Credit Policy Council Executive Director and APRACA CENTRAB President Ms. Jovita M. Corpuz graced the closing ceremony at the ACPC head office.

Chiangmai, Thailand-March 29- EXCOM Meeting Held

EXCOM members joins APRACA Chairman Pham Thanh Tan (middle) in photoshoot.

The APRACA Executive Committee held its 57th meeting at the Royal Princess Hotel in Chiangmai on March 27- 31, 2010. The meeting was being convened by the APRACA Chairman to discuss, among others, salient APRACA matters. The EXCOM also decided during the meeting to recommend to the General Assembly the selection of Mr. Won-Sik Noh, former Executive Vice-President of the National Agricultural Cooperative Federation as incoming APRACA Secretary General effective July 1, 2010.

Host BAAC President Luck Wajananawat welcomes Japanese delegates as Mr. Niphat Kuesakul, BAAC Senior VP, looks on appreciatively.

EXCOM delegates visit organic vegetable project in Chiangmai.

Chiangmai, Thailand-March 29- APRACA launches 3 Centers of Excellence (ACEs)

APRACA Chairman congratulates Bank Indonesia Deputy Governor Budi Rochadi as SG looks on.

In conjunction with the 57th EXCOM meeting APRACA formally launched three APRACA Centers of Excellence (ACEs): ACE-NABARD for linkage banking, ACE-iB for Islamic Banking under Bank Indonesia and ACE-BRI for retail/unit banking.

APRACA Chairman shakes hands with NABARD Chairman Umesh Sarangi.

The APRACA Executive Committee, in its Resolution EC 56/09- 6, approved the creation of APRACA Centers of Excellence (ACEs) to further tap the enormous wealth of knowledge of its member institutions. The creation of Centers of Excellence in APRACA member institutions will provide additional building blocks for further enhancing their ability and capacity to design rural finance programmes, enhance their staff’s technical and training skills, and contribute to building their image and prestige. ACEs will also further strengthen APRACA’s capability to expand rural finance knowledge, pilot test innovations and design innovative rural finance models;

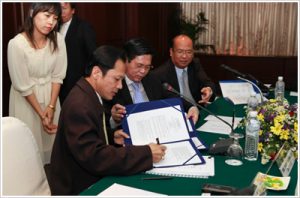

BRI Team Leader Agus Rachmadi co-signs MOU with APRACA Chairman and SG.

ACEs are each focused on a specific topic in rural, agricultural and micro finance. Bank Indonesia Deputy Governor Budi Rochadi, NABARD Chairman Umesh Sarangi and BRI MicroFinance Team Leader Agus Rachmadi, signed their respective institutional MOUs with the APRACA Secretary General and attested by the APRACA Chairman. The three officer-representatives delivered key ACE messages on behalf of their institutions.