Agriculture is one of the most important sectors in developing world. In developing countries, the sector shares substantially greater portion of

Presented at the Policy Dialogue Forum on Value Chain Finance in Agriculture sponsored by the APRACA FinServAccess Project

Sep.3-5, Katmandu, Nepal

Introduction

Agriculture is one of the most important sectors in developing world. In developing countries, the sector shares substantially greater portion of the national economy than in developed countries. Lager percent of population make their living from agriculture related activities in rural area. Most of the rural households are usually small farmers especially in Asia and Pacific region. They engage in basically subsistence or semi-subsistence farming. Poverty prevails among them. Many small farm households are caught up in the vicious circle of poverty: low income-low savings and heavy dependence on debt-low investment-low productivity-low income. Poverty is the cause of poverty and the result of poverty for many small farmers in developing countries.

Supply of farm credit is critical to help poor farmers break out of the vicious circle of poverty. But the conventional approach to agricultural credit, in general, has clear limitations on the accessibility of small farmers; credit institutions are reluctant to provide loans to small farmers in agricultural sector because they lack collateral against the loan in addition to high costs of loan operation, high risks and low returns on investment.

The concept of Microcredit (MC) is regarded as a useful instrument in fighting poverty in developing world. MC usually means small sized loans extended to very poor people for self-employment projects allowing them to care for themselves and their family. The success of Grameen Bank (GB) has attracted worldwide attraction. It seems to be clear that GB approach which does not require any collateral against small credit provided valuable implications to agricultural/rural credit. Nonetheless it is generally observed that loan products under the microcredit are not sufficient to address a wider range of financial needs of the agricultural sector.

On the other hand, value chain financing pays attention to a wider range of input-output relationship between industries that have linkages with agriculture. It is clear that the development of production and supply of farm-input such as improved seeds, farm machinery, fertilizer and pesticide is essential for the benefit of small farmers. More efficient business activities of market participants of the farm products including assemblers, wholesalers, processors can encourage the productive activities of small farmers. Moreover those economic agents in the value chain of farm commodities may even provide credit to small farmers, who have very limited accessibility to ordinary financial institutions, in the form of farm input sale on account, advanced payment or forward sale for farm outputs, contract farming with diversified financial arrangement, and so on.

It is generally observed, especially in developing countries, that the economic activities of the value chain actors are not sufficiently active or efficient to keep face with overall economic growth or to shepherd agricultural/rural development in favor of smallholder farmers. Value chain finance as a systematic/holistic/comprehensive approach to rural development attracts people’s attention. It emphasizes the interrelationship between agricultural production, manufacturing and service industries to remove any bottleneck in the value chain and enhance interdependency to improve efficiency of agricultural sector as a whole

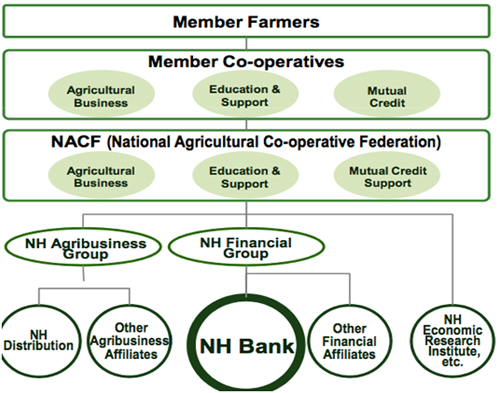

Korea is known to be the first country in the world that transformed herself from an ODA recipient to a donor country. In the process of the transformation, an integrated value chain finance system of multi-purpose agricultural cooperatives has been evaluated as an integral part of agricultural development of the country. Calvin Miller and Linda Jones (2010) noted that the National Agricultural Cooperative (NACF), the national level cooperative organization in Korea, was a successful integrated value chain finance model as Rabo Bank.

In this regard, this paper introduces Korea’s experience of value chain finance in agriculture focusing on the role of the NACF. It tries to describe why and how the integrated value chain finance system has evolved and contributed to the Korea’s transformation from a predominantly agrarian society to an industrialized country during the last several decades.

Leave a Comment

You must be logged in to post a comment.